At Asian Efficiency we help people become more productive at work and in life. Millions of people have now transitioned to working from home and are struggling to get anything meaningful done. For many of them, it’s their first time working from home which is challenging in itself let alone with the pandemic going on at the same time.

At Asian Efficiency we help people become more productive at work and in life. Millions of people have now transitioned to working from home and are struggling to get anything meaningful done. For many of them, it’s their first time working from home which is challenging in itself let alone with the pandemic going on at the same time.

While we’ve written about how to stay productive during the COVID-19 pandemic, there’s another thing happening that’s making it even harder to stay productive.

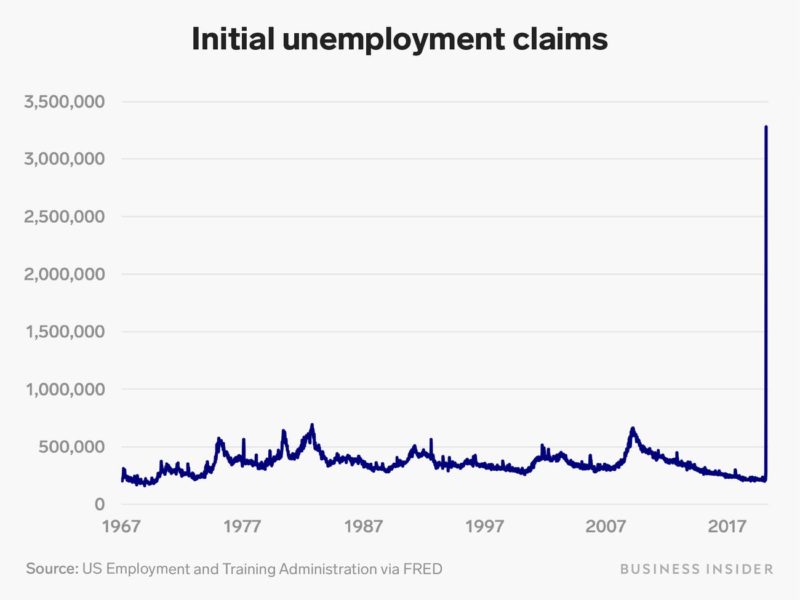

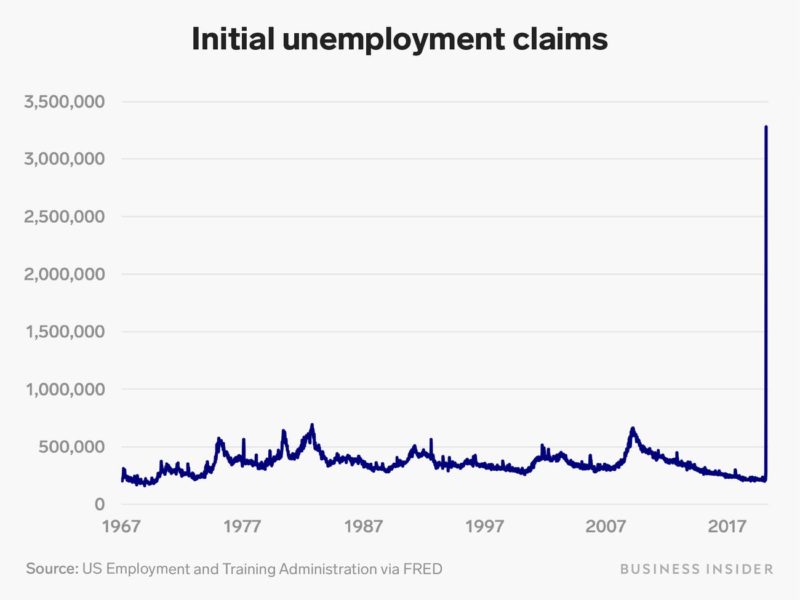

Recently, we had over 3.3 million unemployment claims in the United States in one week. That is the highest number of initial jobless claims in history since the Department of Labor started tracking the data in 1967. To put that in perspective, the highest average for a week previously was 695,000 in 1982. Thanks to the coronavirus pandemic we see a lot of businesses get shut down and people furloughed.

Credit: Business Insider

Credit: Business Insider

When you’re concerned about losing your job it’s even harder to get focused. Last week I was talking to my friend Mel and she works as an accountant for a big luxury hotel chain. She told me all of her coworkers got furloughed and that she was afraid that she could lose her job anytime. With all the stress and uncertainty going on it has taken a major toll on her health, sleep, and productivity.

Three weeks earlier, she declined multiple job offers from big companies in different industries because she loved her employer and co-workers. “Thanh, I wished I had taken one of those offers because I could be working from home and still be working just fine without worries.”

Three days later, Mel got a letter that she was let go.

That’s just one of many stories I’ve heard from friends. The scary part is that this might just be the beginning as economists are predicting a 32% unemployment rate by the end of next quarter. So what can you do to prepare? How can you stay productive during these uncertain times?

A Major Shift in The Way We Work

It’s not all doom and gloom. One of the best things the pandemic has given us is that the work from home bubble has finally popped.

Back in 2009 when I started working from home, it was a novice concept. Between 2009 to 2017, there was a 159% increase in remote work. In 2015, 3.9 million U.S. workers were working remotely. As of early 2020, that number is at 4.7 million, or 3.4% of the US population. With the pandemic, almost all people are now working from home because there is no other option.

However, many industries were resistant to change before the pandemic. There are so many industries where companies and people could have done their work remotely but resisted the change. Industries such as financial planners, medicine, law, dieticians, real estate, and the list go on. They could have done their work from home and still worked with their clients. Yet they didn’t.

Thanks to the pandemic everyone was forced to work from home and this also forced industries to adapt. They had no choice but to figure out a way to make a living. The veil has been dropped and now millions of people have had a taste of what the benefits are working from home. No more long commutes, a flexible schedule, fewer distractions…just to name a few.

The pandemic will be over at some point (hopefully sooner than later) and we’ll all go back to our “normal” lives. However, this pandemic will give many companies and people a new perspective on what a “client meeting” now looks like. Previously, it would have been meeting in an office. Today? It’s virtual. After the pandemic? It will likely be a combination of both. Financial planners can meet clients on a video conference call. Doctors can use telemedicine to diagnose patients without needing an office. The world will change and people will adapt to those new standards. We won’t completely eliminate in-person offices and visits but the time savings, convenience, and effectiveness of remote work will give many of us options that didn’t seem viable before.

So what does this mean for you?

The Shift

In this new economy where working remotely is going to become a new skill, the people that are going to be in the highest demand will be those who will be productive working from home. As we’re entering a new recession, companies will be cutting expenses, letting people go, and go remote. Some will go fully remote and many will introduce work from home days for their people to save costs and increase productivity.

While the pandemic affected us in negative ways, it was a blessing for the “work from home” movement. Post-pandemic we will live in a new world and economy where working from home will become widely accepted.

But here’s the kicker: most people don’t know how to be productive working from home.

They like the idea but struggle with getting things done at home. Just check in with yourself here. Have you found it difficult to get work done at home?

When we ran a survey of the Asian Efficiency audience, many who started working from home for the first time and struggled. Even though they knew about Asian Efficiency strategies, they still struggled! Imagine everyone else who doesn’t know about Asian Efficiency…they don’t stand a chance to be productive at home.

It’s not their fault. No one has ever shown them how to be productive at home. Nobody told them the setup they need at home to be productive. Right now, there’s no resource or training for this. That’s about to change because we’re going to release a Work From Home training series that will help people be productive working from home in early May.

I’ve been working from home since 2009 and Asian Efficiency is a 100% remote company. Everyone except one person had never worked remotely before until they started working at Asian Efficiency (the one exception is Brooks, my co-host of The Productivity Show). I’ve trained single moms, corporate workers, entrepreneurs and a wide range of people to be productive working from home over the years and here’s what I discovered: everyone can be productive working from home.

Yes, everyone can be productive working from home. It’s something everyone can get used to. Just think about the first time when you started working in an office setting. You were young, new to working in this type of environment, and eventually figured out how to get things done. It might have taken you a few weeks or months before you found your rhythm but eventually you got used to it.

If you ever switched careers, departments or jobs you’ve experienced the same feeling. You enter new territory and it takes a bit getting used to but eventually, you adapt and get stuff done. Usually, within a few weeks, you feel comfortable and can thrive.

Working from home is no different! You will feel out of your element at first because it’s new but if you do it long enough you’ll figure it out too. For some that might take a few weeks or months but right now you don’t have time to waste. As companies are laying off people and we’re entering a recession, you can’t afford to waste any time on “figuring out this work from home thing”.

That’s why we’re hosting a live training to show you everything you need to get set up at home, the perfect schedule for working from home, and how to focus at home (even if you have kids and another person living with you). This training, which is called “How to be productive working from home (without going crazy)” will be live and brand new.

Click here to claim your spot for the live training.

Spots are limited and only available during this time. You don’t want to miss this live training.

In this new economy, the ones that will thrive and succeed are people who can be productive working from home. This is the time to prepare yourself and get a competitive edge above everyone else.

Original Source: asianefficiency.com

Affordable healthcare insurance is an essential benefit to offer your employees. Because of the Affordable Care Act, it may even be legally required, depending on the size of your business. To maintain legal compliance, you first need to understand what the ACA is, what recent changes have been made to it and how it impacts your business.

What is the Affordable Care Act (ACA)?

The Patient Protection and Affordable Care Act (also known as the Affordable Care Act, PPACA, ACA or Obamacare) is a healthcare reform law that went into effect under President Barack Obama’s administration on March 23, 2010. The primary objective of the Affordable Care Act is to regulate the cost of health insurance and expand Medicaid coverage. Although some aspects have been repealed under President Donald Trump’s administration, much of the Affordable Care Act is still applicable to your business.

Editor’s note: Looking for the right health insurance plan for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Who benefits from the Affordable Care Act?

The purpose of the Affordable Care Act is to ensure that every American has access to affordable health insurance. Although the ACA presents some challenges for businesses, it benefits several groups, including low-income households, people with preexisting medical conditions and children.

The ACA benefits low-income households, or households with “income limits,” by expanding Medicaid coverage to apply to a larger group of individuals.

“The ACA directly expanded Medicaid eligibility to people falling below 133% of the federal poverty guideline, which in 2020 is $12,760 for a single-person household, $17,240 for a two-person household, and just over $26,000 for the average four-person household,” said Ty Stewart, president and founder of Simple Life Insure.

The ACA directly benefits individuals with preexisting medical conditions who may have previously not had access to affordable healthcare, since it prohibits insurance companies from denying coverage or charging additional premiums due to preexisting conditions.

Children are also allowed to stay on their parents’ health insurance plans until they turn 26 years old, receiving health coverage for several essential services like pediatric and preventive care, lab tests, prescription drugs, and mental and behavioral health treatment.

How the Affordable Care Act impacts your business

Before the Affordable Care Act went into effect, all businesses had the option to offer or not offer health insurance to their employees. The healthcare reform law changed that. The ACA declared that small businesses with fewer than 50 employees can provide their employees with insurance or let their employees sign up for their own insurance coverage separately; however, businesses with 50 or more employees are legally required to offer their employees health insurance.

Reporting health insurance coverage

Rolling out these policies takes effort on your part as an employer. Denise Stefan, president of Engage Insurance Agency at Engage PEO, said that small businesses are required to report the value of the health insurance coverage provided to each employee on annual W-2s, and if you choose health insurance that is considered “self-insured,” then you also have to file an annual report providing certain information for each covered employee.

You may also be required to pay a fee to help fund the Patient-Centered Outcomes Research Trust Fund. “Small employers must also withhold and report an additional 0.9% on employee wages that exceed $200,000 per year,” said Stefan.

Small Business Health Options Program (SHOP) and tax credits

Although the ACA presents a few challenges for small businesses, it also has some benefits for the employer – a primary one being tax credits. Since providing health insurance is not always practical for very small businesses, the Affordable Care Act created the option of affordable health insurance and tax credits for small businesses.

Small businesses with fewer than 50 full-time employees can purchase affordable health insurance through the Small Business Health Options Program (SHOP) – given that they meet the four eligibility requirements. Businesses with SHOP insurance and fewer than 25 employees may qualify for the Small Business Health Care Tax Credit, worth up to 50% of their premium costs. (This may differ by state.)

“Small employers were not mandated to provide coverage, like large employers, but if they had no more than 25 full-time employees, they could take advantage of the tax credit as long as they provided qualifying health insurance for their employees, paid for at least half of the cost of the insurance and paid an average yearly salary of less than $50,000,” said Stefan.

This tax credit is available to eligible employers for two consecutive taxable years and granted based on a sliding scale (i.e., smaller businesses receive larger credits).

Employer mandate penalties

Since the goal of the Affordable Care Act was to reduce the number of uninsured Americans, it originally required everyone who could afford health insurance to either buy it or face a penalty for noncompliance. Although the penalty for individual mandate noncompliance has been lifted, some states may still have penalties in place for qualifying businesses that don’t offer essential health benefits. These penalties often do not apply to very small businesses, though.

“In 90% of cases, small businesses with fewer than 25 employees will not be fined penalties for not offering health insurance, so you can at least breathe easier about that,” said Stewart.

Changes to the ACA in 2020

Many changes have affected the Affordable Care Act over the years, so we spoke with experts to learn the most recent impacts. Stewart said many of the ACA’s largest changes mirror the insurance industry’s broader responses to COVID-19:

More private insurers offering SHOP plans: There has been an uptick in short-term plans being allowed to extend from three months to 12 months, which can save small businesses money if they meet extension qualifications.

No individual penalty: In previous years, individuals had to pay a penalty come tax time if they were uninsured for longer than three consecutive months. In 2020, that individual mandate penalty has been waived. The only exceptions to this are Rhode Island and California, as legislators in these states decided to continue fining uninsured residents.

Rolling enrollment: The ACA and SHOP plans now offer employee enrollment outside the standard enrollment period.

FSA contribution increases: Employees in most cases can increase their contributions to their flexible spending accounts until 2021.

Additionally, many taxes that were initially designed to help pay for the Affordable Care Act have been repealed by both the House and the Senate, in conjunction with the passage of the December 2019 spending bills.

“The health insurance tax, the Cadillac tax and the medical device tax were all repealed as part of the spending bill,” said Stefan. “The repeal of the health insurance tax was passed after most 2020 insurance premiums were already in place. As a result, the effect of the change in that tax will not be felt until 2021.”

When choosing health insurance for your company, it is best to seek an expert on the health insurance marketplace and state requirements for minimum essential coverage.

“My biggest recommendation is to reach out to a SHOP broker or agent in your state,” said Stewart. “These are experts who can provide the most accurate information on pricing and plans available in your state’s marketplace, as well as your business’s exact liabilities. There is so much marketplace variability across the country, so these SHOP brokers really are your best resource.”

Original Source: business.com

At Asian Efficiency we help people become more productive at work and in life. Millions of people have now transitioned to working from home and are struggling to get anything meaningful done. For many of them, it’s their first time working from home which is challenging in itself let alone with the pandemic going on at the same time.

At Asian Efficiency we help people become more productive at work and in life. Millions of people have now transitioned to working from home and are struggling to get anything meaningful done. For many of them, it’s their first time working from home which is challenging in itself let alone with the pandemic going on at the same time.