In between meetings with coworkers, busy periods full of impending deadlines, and a seemingly never-ending list of tasks, some American workers might daydream about the possibility of leaving it all behind for early retirement. While this option isn’t feasible for all workers, retiring early can open a world of possibilities. Early retirees can get a head start on their travel bucket list or even switch career paths. Or, some may just want to spend more time with family.

With that said, retiring early isn’t the right choice for everyone. Early retirement requires budgeting early on in life, aggressive savings, and a firm plan for the future – with the flexibility to absorb the unexpected built in. If you’re interested in learning how you can retire early, it’s important to get a comprehensive understanding of what it involves. Keep reading for a full explanation or jump to a section that answers your question directly.

Why Do Some People Retire Early?

Should I Consider Retiring Early?

How Can I Retire Early?

Why Do Some People Retire Early?

Some of the biggest proponents of early retirement are followers of the FIRE Movement. FIRE stands for Financial Independence, Retire Early, and it’s based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. Up to 70% of all income during their working years goes into savings. When FIRE followers leave the workforce, they plan to live off small withdrawals from their portfolio until they hit the age of 65.

FIRE does have some serious drawbacks to consider. Saving 70% of your annual income can mean you trade an early retirement for a potentially poorer quality of life during the prime of your life. In addition, if the stock market drops or another unexpected event occurs causing a drop in interest rates, those depending on the FIRE plan may have to turn to “Plan B” to get by.

If the traditional FIRE plan seems too extreme, there are more measured approaches to saving for retirement you may want to consider as well. Most of these plans involve putting above-average contributions into retirement accounts, more minimalistic living, and the addition of part-time work with early retirement.

Benefits of Retiring Early

Retiring early offers a range of benefits that can increase your quality of life and allow:

More time with loved ones: One of the biggest reasons why people are attracted to retiring early is that it allows people to spend more time with family and friends.

Ability to travel: The earlier you retire, the less likely you’ll be dealing with age-related health issues – which may impact your dreams of world travel.

Better health: If stress and other health issues related to your job plague your body and mind, retiring early could help restore your health. Retirement means you can sleep later, prioritize exercise, eat three square meals a day, and incorporate other healthy habits that might have fallen by the wayside during your years in a work environment.

Make a different career move: Retiring early also gives you the opportunity to start a new career. Perhaps you want to switch fields, start a new business, or pursue your idea of monetizing a hobby.

Should I Consider Retiring Early?

For many, retiring early is a possibility, but only if you plan early and take a conservative approach. It’s also important to avoid painting an overly rosy view of retiring early; it can be a difficult dream to manifest.

One common way Americans retire early is if their company gives out early retirement offers. COVID-19, in particular, has caused many companies to deliver retirement offers to senior employees in an effort to save money.

But before you decide that retiring early is the right choice, it’s critical to consider the disadvantages as well.

Disadvantages of Retiring Early

Health impacts: Just as retiring could help boost your health, it could also lead to mental declines. Leaving the workforce suddenly can be a difficult lifestyle transition and impact you in ways you weren’t anticipating. In fact, the National Bureau of Economic Research reported that retirement can lead to poor health outcomes. However, that same report also found that retirees who kept up their social activity and exercise were less likely to experience these issues.

Decreased or smaller Social Security benefits: The earlier you start using your Social Security benefits, the less time your benefits have time to grow. In fact, if you start taking your SS benefits at the earliest age of 62, your monthly payments will be 30% less than if you had waited until 67. 67 is what the Social Security Administration considers your “full retirement age.” You can calculate the impact of retiring earlier or later by using the calculator on the SSA.gov website.

Savings stretch: Retiring early sounds great in theory, but if you retire at age 60 and live until 100, your savings would need to last at least 40 years. When you work longer, you have more time to contribute to a 401 (k) and allow your money to compound.

No health insurance coverage: You’ll need to find health insurance on your own until you can get Medicare at age 65. It’s important to note that buying individual health coverage as an older adult is typically very expensive.

Can impact other savings goals: If you have kids, you might be saving for retirement and college. Or, perhaps you’re also saving for a home. Aggressively saving for retirement might not be realistic when other savings goals are more pressing.

How Can I Retire Early?

If you decide to retire early after weighing the pros and cons, it’s important to spend adequate time actually planning for it.

Start by reading tips from investors who retire early and other workers who made their retirement happen years earlier than expected. Although anecdotes shouldn’t form the basis of your early retirement preparation, reading the accounts of like-minded individuals can help you anticipate potential problems you may encounter. These stories might also expand your understanding of what it’s really like to retire early – and give you some insight into whether you’re equipped to handle those realities.

Besides gathering knowledge and doing your due diligence, it’s also important to sit down and crunch the numbers to see if becoming a younger retiree is possible. Here are a few steps you should take to build a basic framework for your early retirement:

Calculate your annual retirement spending. To do this, look at your current monthly spending and take into account what expenses might increase or decrease. Add your monthly expenses and multiply that number by 12. Ideally, you’ll increase it by 10% to 20% to work in wiggle room for unexpected expenses or splurges.

Estimate your total savings needs. A common rule of thumb is aiming to save 25 times your planned annual spending saved before you retire. Your exact number may be more or less depending on your lifestyle and other relevant variables.

Invest. It’s also important to invest in a retirement portfolio set up for long-term growth. Make sure that you’re contributing enough to your retirement accounts in the context of your retirement horizon. Retiring early means you have less time to let your retirement investments grow.

Focus on paying down debt. Get out of debt so you can focus on saving. Money that isn’t going to pay your debts could be growing in a retirement account.

Stick to your budget. And finally, it’s important to stay on track with your budget so you can actually achieve your retirement goal. Consider evaluating your savings and investments each month to make sure you’re on the right path.

Considerations to Factor into Planning

Besides doing the math to help you reach your retirement goals, it’s also important to know exactly what kind of retirement you want. Are you planning on retiring in your hometown? Are you aiming to move to a tropical destination? Or, do you want to relocate somewhere with a cheaper cost of living? You’ll need to factor in those kinds of living costs and lifestyle choices into your overarching plan.

Takeaways: Early retirement and planning for the future

Early retirement isn’t right for everyone. At the end of the day, retiring early can involve more risk than traditional retirement. You might have to tap into your Social Security and, in turn, lower your monthly payment potential. A downturn in the market can mean your portfolio returns aren’t as high as you expected. If you do decide to plan for early retirement, it’s important to build in flexibility and consider a middle-road approach. Perhaps you can consider keeping a side job to tide you over until you qualify for Medicare, for example. With these tips, you can plan a happy, successful retirement with peace-of-mind.

The post Early Retirement (What to Consider & How to Retire Early) appeared first on MintLife Blog.

Original Source: blog.mint.com

Most health plans have an annual deductible—the amount you are responsible for paying before your insurance starts to cover you. If you’re lucky, you’ll have a very low deductible, or even none at all.

In many ways, the deductible is what stands in between you and your full health insurance benefits. It’s like the first hurdle you have to clear before your health plan starts to give back those premiums you paid. So, managing your deductible is key to understanding your plan and saving money.

If you’re one of the many people who find it difficult to keep track of where they are on their deductible, you might try one of the new online services, like Simplee or Cake Health, which are designed to make this much easier. In this post, we’ll explain what a health insurance deductible is, what you need to know about them, and more. Use the links below to jump to the section that best answers your query, or read through for a more detailed overview on the subject.

What is a Health Insurance Deductible?

How do Deductibles Work?

Example of health insurance deductible

Essential Things to Know About Your Annual Deductible

Choosing the Right Deductible Amount

What is a Health Insurance Deductible?

Health Insurance Deductible Definition: A health insurance deductible is defined by HealthCare.gov as the minimum balance you pay before your insurance company starts to cover medical costs. If your deductible is $2,500 and your medical visit costs $5,000, for example, you would be responsible for the $2,500 portion. In other words, you are responsible for paying a certain amount of your medical expenses yourself, and your insurance company will begin to cover costs only after you have paid that deductible.

How do Deductibles Work?

After you’ve met your deductible, your provider will typically only ask that you cover a portion through coinsurance or copayment while they handle the rest. Keep in mind, every insurance plan is different, so it’s important that you not only understand how deductibles work, but also how they fit into your plan specifically.

Certain insurance plans will cover services such as checkups or preventative care even before your deductible is met, so be sure that you know your plan details through and through before you do or do not seek care.

Example of health insurance deductible

Let’s take a look at an example of how deductibles work to get a clearer understanding:

Let’s pretend that you have a health insurance plan with a $700 deductible. One day, you require a medical procedure that costs $7,000, which is covered in your plan. Your health insurance provider will help pay for these costs, but only after you’ve met your $700 deductible. Here’s what happens next:

You pay your $700 deductible out of pocket to the provider

Then, after you meet the deductible, your health insurance plan begins to cover the remaining balance of $6,300

Depending on your plan’s copay or coinsurance policies, you may still be required to pay a percentage of these costs

High-deductible plans vs. low-deductible plans

High-Deductible Health Plans (HDHPs) have higher deductible rates than most insurance policies, but offer up some flexibility and tax advantages that can come in handy for some individuals, plus, HDHPs typically have lower monthly premiums. HDHPs come with a Health Savings Account or a Health Reimbursement Arrangement (HRA), a tax free account where you can deposit money specifically to be used for future medical costs. Aim to have saved in your Health Savings Account at least as much as the deductible. What counts as an HDHP? For 2021, the deductible is at least $1,400 for individual plans or $2,800 for family.

Low-Deductible Health Plans typically have lower deductibles but lower monthly premiums than plans with higher deductibles. If you need a considerable amount of care or require expensive medical services, a low-deductible plan may be worth considering because your insurer will start covering costs at a lower rate than high-deductible plans.

Essential Things to Know About Your Annual Deductible

Enrolling in a healthcare plan can be an overwhelming experience — from unfamiliar terminology to crunching costs, there’s a lot to learn before you can find the best coverage for your needs. Whether you’re planning to enroll soon or just need to clear up some long-held confusion, here are some of the most important things to know about how deductibles work, and what you should know about yours.

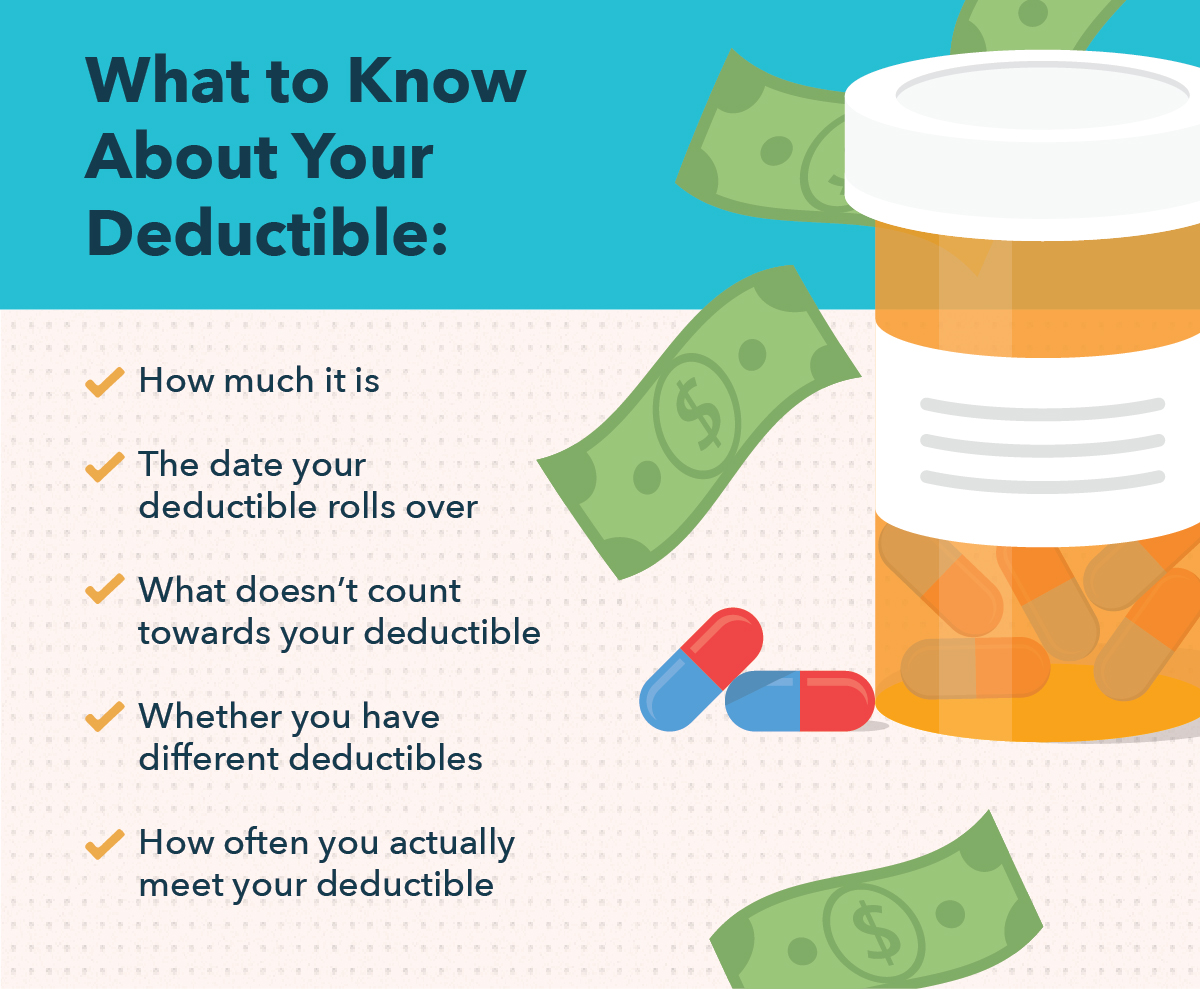

1. How much is your deductible?

You should know how much your deductible is before you ever enroll in a plan. If the plan has a low premium, there is a good chance the deductible will be high. You should ideally have the money to pay your deductible ready on hand—or at least be saving for it. Remember, before your insurance company will pitch in for your medical expenses, you’ll need to pay the deductible you agreed upon first.

2. The date your deductible rolls over

Health insurance deductibles usually roll over every January, but some plans may use a different date—for example, health plans through schools or universities may use the academic year. This date is important because you may want to plan your appointments and procedures to occur after your deductible is met and before the year rolls over. Or, you may need to budget more money for the early part of the year.

Let’s say you have a $1,000 deductible and you meet it in June. Any other services you get for the rest of the year will only cost you copays or coinsurance. But if you wait until January, you will have to pay $1,000 all over again. You might consider scheduling bigger procedures before January to save you some cash if you are not planning other expensive services (that will again exceed $1,000) for the next year.

3. What doesn’t count towards your deductible

Many health plans waive the deductible for services such as preventive care or the emergency room fee if you are admitted to the hospital. Check your policy so you know where you get a free pass, and take advantage of it.

4. Whether you have different deductibles

Some plans have separate deductibles for in-network care versus out-of-network care. This could cost you more money unnecessarily if you’ve met one deductible and then see a doctor that counts towards the other. So, find out the rules and always check whether providers are in-network before you go (don’t make assumptions—doctors in the same office may not all take the same insurance).

If you have a family policy, check if there are separate or combined deductibles for each member that is covered. The rules can vary on this one, too.

5. How often you actually meet your deductible

Odds are, if you purchased health insurance, you hope that it will pay for the health care you use. So if you find that every year you come close to meeting your deductible but never do, you may be tempted to get a plan with a lower deductible so that you end up paying less out of pocket. Be aware, though: premiums for lower-deductible plans might be higher than you would end up saving. Make sure you consider the full cost spectrum of premiums, copays, coinsurance, and how much health care you expect to get that year when you weigh this decision.

Choosing the Right Deductible Amount

Now that you know how deductibles work, you may be wondering how you should choose the right deductible for your health care needs and financial situation. In this section, we’ll discuss some of the things you may want to consider as you evaluate your health insurance options.

Things to consider when assessing health insurance deductibles:

Necessary coverage: Ultimately, the health care plan that you choose should empower you to get the best care for your needs. Whether you visit the doctor on a frequent or infrequent basis, your health history should be a primary part of your decision-making process. As you weigh your options, think about what the expenses that you’d be liable for would look like with a high, low, or middleroad deductible.

Budget: Not only does your health insurance determine the kind of care you’re entitled to, but it’s also a major financial commitment. In addition to deductible costs, consumers are responsible for premiums and other out-of-pocket costs. Before selecting a health insurance plan, be sure to consider the full insurance terms as well as all of the costs you may be held responsible for.

Note: As you calculate your budget and insurance costs, don’t forget that there are ways to maximize your health care deductions to lessen the financial burden.

Tomer Shoval is the CEO and Co-Founder of Simplee, a free online personal health care expense management tool. Connect with him on twitter, facebook or email.

The post Understanding Your Health Insurance Deductible appeared first on MintLife Blog.

Original Source: blog.mint.com