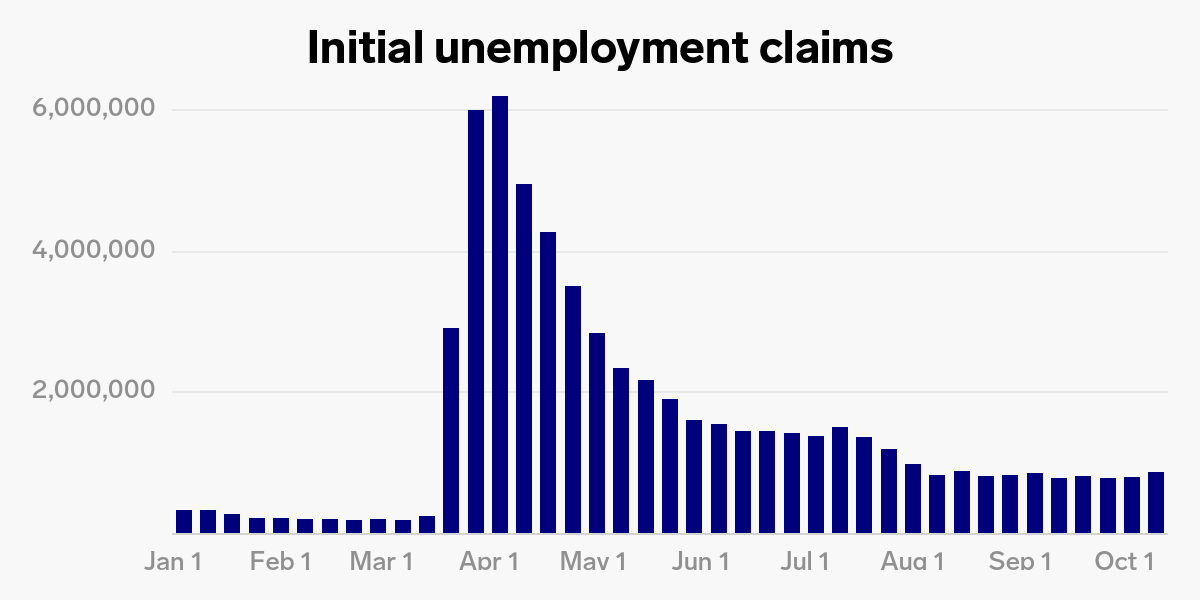

US weekly jobless claims rise to 898,000 as labor-market recovery stumbles

Matias J. Ocner/Miami Herald/Tribune News Service via Getty Images

New US jobless claims for the week that ended Saturday totaled 898,000, the Labor Department said Thursday. The reading came in above the consensus economist estimate of 825,000, and also marks an increase from the previous week’s revised figure.

Continuing claims, which track Americans receiving unemployment benefits, fell to 10 million for the week that ended October 3. That was lower than economist forecasts.

Visit Business Insider’s homepage for more stories.

The number of Americans filing for unemployment insurance rose last week, indicating discouraging progress around the US labor market’s ongoing rebound.

New US weekly jobless claims totaled an unadjusted 898,000 for the week that ended Saturday, the Labor Department announced Thursday morning. That reading came in above the median economist estimate of 825,000 compiled by Bloomberg, and also reflects an increase from the prior week’s revised total.

Continuing claims, which track the aggregate total of Americans receiving unemployment benefits, slid to 10 million for the week ended October 3. The reading came in slightly below the median economist estimate of 10.6 million.

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”])for(var e in a.data[“datawrapper-height”]){var t=document.getElementById(“datawrapper-chart-“+e)||document.querySelector(“iframe[src*='”+e+”‘]”);t&&(t.style.height=a.data[“datawrapper-height”][e]+”px”)}}))}();

Roughly 65 million unemployment-insurance filings have been made since early February, trouncing the 37 million sum seen during the 18-month Great Recession. Thursday’s report comes in well below the highs seen earlier in the pandemic but still lands above the 665,000 filings made during the Great Recession’s worst week.

The millions of Americans still unable to find work are set to endure tougher economic conditions in the near term. Democrats and Republicans remain far apart in reaching a stimulus compromise, and Wall Street economists increasingly expect new fiscal relief to arrive after the November elections.

While most polls point to a strong Biden victory in the presidential race, Senate election outcomes will “mean the difference between substantial fiscal expansion and fiscal gridlock,” Morgan Stanley said in a Wednesday note.

The lack of another expansion to unemployment benefits also leaves jobless Americans more prone to lingering debt through the pandemic. A recent study by researchers at the Federal Reserve Bank of New York found that Americans on unemployment insurance benefits used nearly half of the benefits to pay down debts. Roughly 24% of the payments were used for buying essential goods, and 23% were saved.

Read the original article on Business Insider

Original Source: feedproxy.google.com

Visited 586 Times, 1 Visit today