ADX Indicator Average Directional Index ADX Indicator Formula IFCM India

Contents

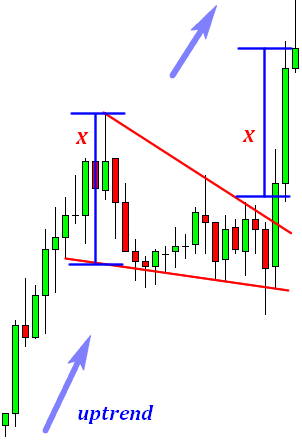

Adx indicator on alone does not signify whether the trend is Uptrend or Trend is Downtrend. Before buying a stock, we must analyze the trend of the particular stock in a weekly and monthly chart. If ADX is above 25 and the +DMI line moves upwards, which is from below to above the -DMI line then this indicates a buy signal. When ADX is below 20, price enters range conditions, and price patterns are often easier to identify. Price then moves up and down between resistance and support to find selling and buying interest, respectively.

ADX is primarily used to quantify the strength of a trend. ADX is calculated based on the moving average of a price range spanning over a given period. The default ADX is calculated for 14-time units, although other periods can be used.

Here, you could either buy the stock or enter a long position according to your strategy. On occasions, the ADR line can go above the 50-level mark as well. A reading between 50 and 75 shows an extremely strong trend.

Average Directional Index (ADX)

DM is calculated using current high/low and previous high/low prices. When ADX is below 20, price enters a sideways or consolidation. how to calculate hhi index in excel Low ADX is a usually a sign of accumulation or distribution. • When +DI is above -DI then trend is considered as an uptrend.

• Once ADX gets above 20 then start employing trending trade system. Big moves tend to happen when ADX is right above this number. • Value of ADX below 20 is called trading zone which implies non-trending market. • +DI is crossing over -DI signals trend reversal to bullish trend. Things changed in late February when markets realised that Covid-19’s impact on insurers could be significant.

(At least making a back-test using end of day data give me great results). When the price touches the 20-period moving average, put a buy stop above the high of the previous bar. Look for a retracement in price to the 20-period exponential moving average. This will usually be accompanied by a turndown in the ADX. The single best signal of the Directional system comes after ADX falls below both Directional lines. The longer it stays there, the stronger the base for the next move.

Save 90% Brokerage Now!

Some traders suggest this indicator to Trade-Ideas support, and I think it will be added in future updates. The first thing I did after reading this thread, is creating a trading system based on this indicator and back-testing it. The problem is I don’t have tick data, so I used end of day data, and came up with very nice results, so I really suggest you to consider the ADX and to do your home work (back-testing).

If ADX is above 23 and the +DMI line moves downwards, which is from above to below the -DMI line then this indicates a sell signal. One of the most accurate indicators used in trading to book more profits is ADX or Average Directional Index. Using following three indicators together, chartists can determine direction as well as strength of the trend. ADX is a lagging indicator that measures the trend strength without regard to trend direction. Above all, the value should be beyond 20, and +DI should be greater than –DI. On the other hand, it is a sell signal if the price is falling down, and besides, the ADX indicator is also rising, and the value is beyond 20.

- Hello traders, I am here again with a new and improved indicator.

- It looks for green candles in the graph and reads a higher value when there are more green candles.

- ADX as a Range Finder indicator – trade hates price trade in range.

- ADX indicator is used to find whether Stock is in trend and also finds the strength of the trend.

- There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

- Before buying a stock, we must analyze the trend of the particular stock in a weekly and monthly chart.

He developed the indicator in 1978 as a combination of two directional movement indicators. Trend trading is known to be a lucrative strategy if executed correctly. That’s why there are indicators specially designed to identify the strength of trends or at least parts of them. One such indicator https://1investing.in/ that does both is the Average Directional Movement Index. Similarly , you can use ADX along with Supertrend also to take buy or sell trades. If we get Supertrend buy SIgnal land ADX is above 25 , means buy signal may work well as buy signal has come in a strong trending stock.

BPCL: Will the Oil Major Deliver Major Returns in the Time To Come?

Traders should try to enter the momentum when the ADX line moves above 25 and hold positions until zone is sustained. For example in Angel One, traders get about 100+ technical indicators to experiment with and thus create varied strategies altogether. The ADX is also sometimes used, as other momentum indicators are, as a divergence indicator that can signal an impending trend change or market reversal. The ADX can be used to make short term profits by trading in the direction of strong trends.

Detecting a strong directional move is the most important skill for all traders to have. Trend chasing is the most popular technical method of profitable trading. But stock prices spend more time in consolidation and less time in trending move and so trend trading are prone to frequent drawdown. So before employing trend trading it is important to know whether the stock is in a trend or not. To avoid such tedious work, market participants use ADX in conjunction with other indicators like Relative Strength Index , The Moving Average Convergence Divergence , Stochastic, etc.

Welles Wilder in order to evaluate the strength of the current trend. Combing price-action breakout along with ADX can maximize the chance of locating the strongest breakouts to trade. In the chart the ADX line is the white line and when the ADX line crosses above the 20 level it is marked with black circlein the chart and we see there is a clear trend in the stock. This really clearly shows up and down, but using VOLUME! Don’t ignore it, there is too much information captured in the OBV.

For Trader

If you just love the ADX/DI format, it is included in a checkbox. Want some excellent background highlighting, turn in on in a checkbox. Use indicators after downloading one of the trading platforms, offered by IFC Markets.

Directional movement is positive when the current high minus the prior high is greater than the prior low minus the current low. This so-called Plus Directional Movement (+DM) then equals the current high minus the prior high, provided it is positive. For instance, when ADX starts to slide below 50, it indicates that the current trend is losing steam. From then, the pair could possibly move sideways, so you might want to lock in those PROFITs before that happens. EUR/CHF broke below the bottom of the range and went on a strong downtrend.

Calculating the ADX

ADX is non-directional, and together, the DIs and ADX measure both direction and strength of a trend. ADX is computed based on moving average of price over a period. It is plotted as a line, on a range between zero and hundred. It was conceived by Welles Wilder Jr., who designed it to measure the directional movement of commodities and price, but ADX is now widely used for stocks as well. As the name suggests, since the ADX line only determines trend strength, the two DI lines help the trader in understanding the direction of the trend more accurately. Together these three lines predict the presence of a strong trend in the market.

Here, pay attention to the area where the green line crosses above the red line. At that point, ADX is clearly above the 25-level mark as well, showing that there is a strong trend. If you look at the chart, you can see that the price goes up after the signal.

Visited 184 Times, 2 Visits today