If you’re like the majority of homeowners in the U.S., you make your mortgage payment monthly, with the idea that someday you’ll own your home outright. As you continue to pay off your total balance, your home equity rises and you become one step closer to owning your home.

The downside is, mortgages, like any other type of loan or line of credit, come with interest. That means you pay the total balance owed, plus the annual interest rate applied to your mortgage loan. Additionally, your lender also assigns specific payment schedules and other terms to your loan, some of which you might find favorable, others not so much. That’s where refinancing comes in.

What does refinancing mean? In the most basic sense, refinancing is a way to alter your mortgage terms by replacing your old mortgage with a new one that is better fit for your financial situation. A lower interest rate, more manageable payment schedule, a shorter loan term, or consolidating multiple mortgages are just a few of the ways refinancing your mortgage can be beneficial.

In this post, we’ll answer some important questions, such as, “what does refinancing mean?”, “when is refinancing a good idea?”, and “what are the pros and cons of refinancing?”. For fast answers on the subject of refinancing, use the links below to navigate ahead. Or, read end-to-end for a complete overview.

What is Refinancing?

Pros and Cons of Refinancing

Refinancing FAQs

What is Refinancing?

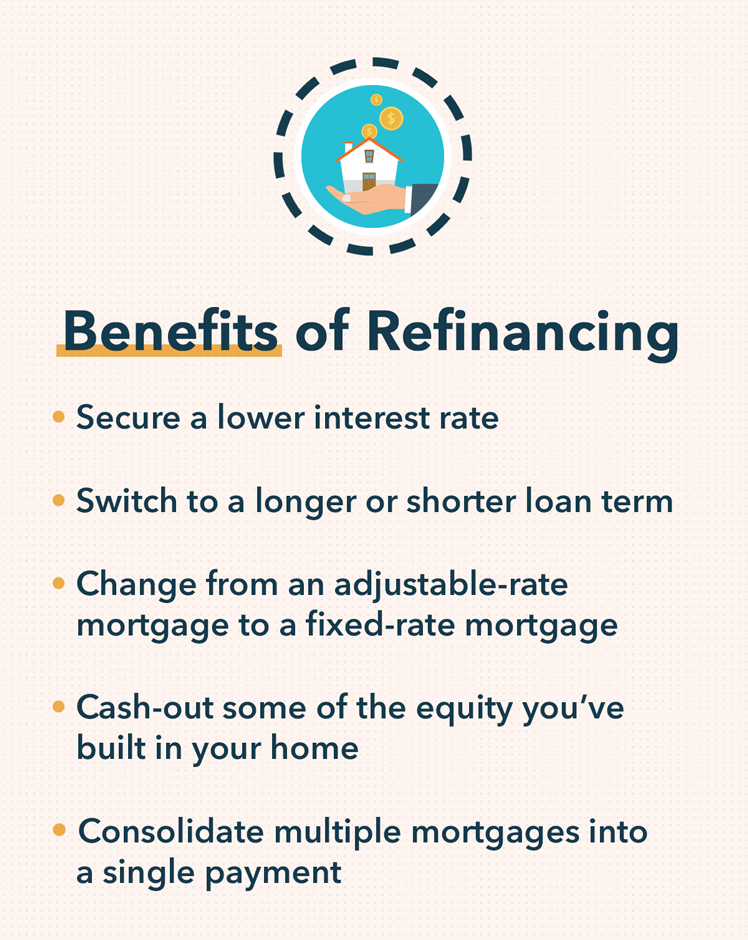

Refinancing, also known as “ a refi”, is a way for borrowers to restructure their mortgage, auto, personal, or other loan type for more favorable terms. During the mortgage refinance process, you might make one or several of the following adjustments to your mortgage:

Secure a lower interest rate

Switch to a longer or shorter loan term

Change from an adjustable-rate mortgage to a fixed-rate mortgage

Cash-out some of the equity you’ve built in your home

Consolidate multiple mortgages into a single payment

Sounds pretty good, right? It can be. Anytime you’re dealing with changes to a loan, it’s a good idea to read the fine print, take a close look at the pros and cons, and really understand what happens when you refinance.

What happens when you refinance?

When you refinance a loan, whether it be a mortgage, auto, or some other line of credit, you’ll need to start by paying off your original loan, which you can do with the help of your refinanced one, after you’ve been approved for a new loan, of course. Once you have settled up with your original lender, you’ll be left to pay off your new loan according to the payment terms outlined by your new lender.

Am I eligible for a refinance?

Think back to when you applied for your original mortgage — you likely filled out an application, they checked your credit score and lending history, assessed the property, and proposed a mortgage option for you based on your financial profile.

The process for refinancing is essentially the same. The new lender will consider your credit score, lending history, the value of your home, how much you want to borrow, and your income and assets before approving you for a new mortgage. Ideally, your finances would be in a shinier state than when you got your first mortgage, and you’ll likely be asking to borrow less money, therefore, a refinanced mortgage could offer you a more agreeable interest rate or loan terms.

When it comes to determining eligibility, it’s ultimately up to your lender to decide. According to Rocket Mortgage, homeowners looking to refinance should consider the following criteria before applying:

How long you’ve owned the house: Generally, you must have the title for a minimum of six months.

Your credit score: Your lender is ultimately the one who decides what they consider to be a “creditworthy” score, but there are some basic benchmarks you can use to help. A good credit score is considered 670 and higher on the FICO scale and 660 and higher on the VantageScore model.

Your current home equity: The general rule of thumb is that homeowners should have a minimum of 20 percent home equity in order to qualify for a refinance. 20 percent is also the minimum equity needed if you want to get rid of your mortgage insurance.

Other debts: In addition to assessing your credit score and other financial metrics, lenders will typically consider your other debt obligations before approving you for a new loan. Take a look at how you’re managing your current debts before applying for a refinanced mortgage.

Closing costs: When you close on a loan, you’re typically responsible for paying closing costs, including, appraisal fees, title fees, credit check fees, and more. Before applying for a refinance, take a look at your monthly budget to determine whether or not you can afford to pay the closing costs on a new loan. ProTip: Use our budgeting calculator to help!

Financial details: Part of the loan application process involves lenders taking a look at the greater picture of your finances, such as, your income and assets, homeowner’s insurance, title insurance, etc. Make sure you have this information handy to make the refinance process more efficient if you choose to proceed.

Types of mortgage refinancing

Now that you know the basic refinance definition, it’s time to dig a little deeper. It probably comes as no surprise to you, but it’s important to know that there’s no one-size-fits-all refinance. There are several different types of mortgage refinancing that depend on the outcome that you’re looking for.

Rate-and-term refinancing: This type of refinance only adjusts the rate and/or term length of the loan.

Cash-out refinancing: Allows borrowers to adjust the mortgage length and/or term, plus, it increases the amount of the loan. Cash-out refinances are generally used when homeowners want to borrow extra money to make home improvements or other big purchases.

Cash-in refinancing: This is basically the opposite of a cash-out refinance. With cash-in refinancing, you’d pay down more of the principal balance to decrease your loan amount, generally in exchange for a lower mortgage rate.

Note: Another reason some homeowners choose to refinance is to consolidate their debts; instead of making mortgage payments to separate lenders for multiple mortgages, you could refinance and lump all of your mortgages into a single loan.

Pros and Cons of Refinancing

Like any financial decision you’ll make in your lifetime, it’s a good idea to consider the pros and cons of your decision. With that said, let’s take a look at some of the benefits and risks associated with refinancing.

Pros

The advantages of refinancing are simple: making your mortgage terms work better for you. That could mean getting a lower interest rate, which would translate to interest savings, you could secure more manageable monthly payments which might work better for your budget, or you could adjust your loan terms to better suit your lifestyle and financial situation.

Cons

Penalty fees: Some mortgage lenders impose penalty fees if you pay off your mortgage before the term ends. These fees vary by lender, but could potentially add up to thousands of dollars.

Closing costs: As we mentioned, there are several closing costs associated with refinancing. Keep these costs in mind as you weigh your options.

Longer loan length: Should you choose to extend the length of your loan term in favor of lower monthly payments or some other benefit, you’ll be stuck paying off your mortgage longer, which could be problematic for certain homeowners.

Refinancing FAQs

So far, we’ve answered “what is refinancing?”, “what happens when you refinance?”, “what are the types of refinancing?”, and “what are the pros and cons of refinancing?”. If you still have some lingering questions, we’re here to help by answering these refinancing FAQs.

Does refinancing hurt your credit?

One of the costs of refinancing is that it may impact your credit temporarily. When you apply for a loan, your lender will check your credit score , conducting something that’s called a hard credit inquiry. Hard credit inquiries can drop your credit score by a few points, but it won’t impact your score forever.

Bottom line: Refinancing can hurt your credit score temporarily. However, if the savings and benefits are worth it, a quick dip in your score probably isn’t something to be too concerned about, especially if your credit is in good standing.

Is refinancing a good idea?

It depends. Everyone’s financial situation is different, so it’s important to take a close look at your current situation, assess whether you’re eligible for refinancing, and really understand what it means to refinance.

When is refinancing worth it?

Refinancing may be worth your while if you can qualify for a lower interest rate or secure better loan terms than you started with. Some financial experts say that refinancing can be a good idea if you can lower your interest rate by at least two percent.

How do I calculate the break-even period?

Something to consider when you’re refinancing your mortgage is how long it will take you to reap the benefits of your new loan after considering closing costs. Use the worksheet below to help you anticipate your break-even period.

Graphic

Recapping Refinancing

There are plenty of nuances to know about refinancing. As you consider whether it’s the right move for you, let’s recap some important points:

What does it mean to refinance?: Refinancing a loan is when you pay off your original loan and take out a new loan, ideally with more favorable loan terms like a lower interest rate or more manageable payment schedule.

When is it a good idea to refinance?: That depends on your unique financial situation. Refinancing can help you save money on interest and offer other important benefits, but it’s important to consider the benefits and risks in the context of your own finances.

To learn more about where your finances stand, check out the Mint app to set financial goals, glean insight into your financial health, and more.

The post What Does Refinancing Mean? Refinance Your Mortgage appeared first on MintLife Blog.

Original Source: blog.mint.com

Morsa Images/Getty Images

Morsa Images/Getty Images

Mortgage rates are at historic lows, and while there are no hidden fees that accompany a low APR, there are a couple trade-offs to keep in mind.

You may find a lower rate with an adjustable-rate mortgage (ARM) than with a fixed-rate mortgage, but the ARM rate could increase when the introductory rate period ends.

If your down payment is under 20% of the home value, you’ll have to pay private mortgage insurance (PMI), which could add hundreds or thousands of dollars to your annual payments.

You probably don’t need to rush to buy a home with a low rate, because mortgage APRs will likely stay low in 2021.

Policygenius can help you compare homeowner’s insurance policies to find the right coverage for you, at the right price »

Mortgage rates are at historic lows, so it could be a good time to buy a home. But you may be wondering whether there is a downside to low rates.

In short — nope, there’s no catch. A low APR can save you thousands over the life of your loan.See the rest of the story at Business Insider

See Also:

5 reasons term life is almost always a better choice than permanent life insurance for US householdsHow to fill out a money order and send a payment securelyInstead of saving a total sum for retirement, I started thinking about how much I want to ‘earn’ monthly and it made me reassess the way I invest

Original Source: feedproxy.google.com

Courtesy Eric Rosenberg

Courtesy Eric Rosenberg

When the Federal Reserve lowered interest rates in response to the COVID-19 pandemic, I jumped at the opportunity to save money by refinancing my mortgage.

While I was already focused on my mortgage and home costs, I decided the time was right to shop around for homeowners insurance to see if I could save money.

I found new homeowners insurance and earthquake insurance through Policygenius that offers comparable coverage at a lower cost.

Policygenius can help you compare homeowner’s insurance policies to find the right coverage for you, at the right price »

Earlier this year, the Federal Reserve lowered interest rates in response to the COVID-19 crisis, and mortgage rates quickly followed suit. My wife and I decided the time was right to join a large number of homeowners in locking in historically low interest rates. Then, we turned our attention to our homeowners insurance.

My original mortgage and homeowners insurance

When my wife and I bought our home in 2017, we signed up for a 30-year mortgage with a fixed 4.25% interest rate. That rate was very competitive at the time and we were happy with how the loan came together.See the rest of the story at Business Insider

See Also:

I ran my taxes through Credit Karma Tax and H&R Block. Here’s how they compare on price, ease of use, and refunds.3 things to consider before switching to a new high-yield savings account as interest rates dropWhen to use a cashier’s check, and how to get one

Original Source: feedproxy.google.com

The mortgage industry (and interest rates) have a somewhat complicated relationship with the rest of the overall economy. Generally speaking, when the economy is doing very well, the Federal Reserve will start raising interest rates. This can help to try and ward off inflation which is not great for the economy. Conversely, when overall economic conditions are poor, the Federal Reserve will LOWER the interest rates, in an attempt to spur economic growth. Since the interest rates on most mortgage products are (directly or indirectly) tied to the overall Federal Reserve interest rate, these actions have a pretty significant impact on mortgage interest rates.

Mortgage rates can fluctuate daily or even hourly, so it’s good to have a basic idea of what you want to do and what might make you want to refinance. With mortgage rates at historic lows, let’s take a look at what that means and whether you should refinance while rates are low.

Mortgage rates are at historic lows

The mortgage market is a fairly complicated market with several different types of mortgages available. So when you hear that mortgage rates are at “historic lows”, it’s important to understand what type of mortgage is being talked about. Usually, the 30-year fixed mortgage is the loan product that is considered the “standard” mortgage. So if you hear about rates “dropping”, you’re usually hearing about the 30-year fixed. It is true that usually (but not always!) rates for different types of products rise and fall together.

(SEE ALSO: What is a “Good” interest rate?)

It was not uncommon in the 1970s or 1980s to see mortgage rates with double-digit interest rates. Since that time, interest rates have generally steadily dropped, to a low around 3.5% in 2012. Mortgage rates fluctuated in the 3-4% range for the next several years before rising to around 4.5% in 2018 and 2019.

The recent coronavirus pandemic has affected the housing market and sent rates on the 30-year fixed mortgage down under 3.5%, around the lowest those rates have ever been.

Should you refinance to a 30-year mortgage?

As the name implies, a 30-year fixed mortgage will lock in your interest rate for the duration of your loan. You’ll have 360 monthly payments, all of the same amount. The exact amount you pay will depend on the amount of your loan, the duration and the interest rate. You can use our Loan Repayment calculator to find out the exact amount of your monthly payment. Keep in mind that that monthly payment amount will not include your property taxes or home insurance. Your lender may require that you set up an escrow account, or else you’ll need to make sure to budget for those expenses on top of your monthly mortgage payment.

The 30-year fixed mortgage will usually give you your lowest monthly payment. In fact, even if you currently have a 30 year fixed mortgage, you will likely save on your monthly payment by refinancing now. That is because of 2 reasons – the rates are likely lower than when you first got your mortgage and because you’ve paid down your mortgage balance so the amount you’re refinancing is less.

Should you refinance to a 15 or 20-year mortgage?

Another option to consider when refinancing is to refinance to a 15 or 20-year mortgage. A mortgage with a shorter term (like 15 or 20 years) will usually have a lower interest rate than the 30-year fixed mortgage. However, because the shorter term means there are fewer payments, your payment may still go up.

If you’re currently on a 30-year mortgage, you’ll likely (but not always) find that the monthly payments on a 15 or 20-year mortgage will be higher. The good news is that your mortgage will be paid off 10 or 15 years sooner! Overall you’ll pay quite a bit less in interest.

An example of refinancing to a shorter-term mortgage

To illustrate the types of choices you have with refinance, let’s look at an example. Our fictional homeowner bought her house 5 years ago with a mortgage of $250,000, and took out a 30 year fixed mortgage. Her monthly principal and interest payments have been $1,267 per month, and after 60 payments, her mortgage balance is now $228,305.36 with 25 years remaining.

She’s looking to refinance with today’s low rates. We’ll say that her closing costs will make her new loan payoff amount $230,000. Again using our Loan Repayment Calculator, here are some options she could consider:

A 30 year fixed loan at 3.5% – monthly payments would be $1,033.

A 20 year fixed loan at 3% – monthly payments would be $1,276.

A 15 year fixed loan at 3% – monthly payments would be $1,588.

You can see that refinancing to another 30-year mortgage would drop her payments by $234 each month. That comes at a cost of adding 30 more years to the total time it takes to repay. With a 20 year loan, her payments only go up $9 per month but she shaves 5 years and tens of thousands of dollars of interest over the course of the loan. A 15-year loan would pay even less interest but at a cost of increasing the mortgage payment by $321 each month.

Of course, every situation is different but hopefully, this can serve as a guideline to help you as you make your own decisions about refinancing.

The case against refinancing

Even though mortgage rates are at historic lows, refinancing is not right for everyone. Here are a few cases where it might not make sense to refinance, even if today’s interest rates are lower than the rate on your current mortgage:

You’re not sure if you’ll be in your home long term. Refinancing does come with some upfront costs, and if you won’t be in your home long enough to pay them back, it might not make sense

Your credit score or financial situation has taken a recent hit

You want to take advantage of some of your home’s equity with a home equity line of credit.

You don’t have enough money to pay the upfront closing and other costs associated with a refinance. If this is the case, see if it might make sense to roll those costs into your new loan.

For even more information about the pros and cons of refinancing, check out our list of 8 refinancing tips

The post Should You Refinance Your Mortgage While Rates Are Low? appeared first on MintLife Blog.

Original Source: blog.mint.com

adamkaz/Getty Images

adamkaz/Getty Images

US home mortgage delinquencies surged to the highest level since November 2011, according to a Monday report from Black Knight.

Total borrowers more than 30 days late skyrocketed to 4.3 million in May from 3.4 million in April, the report showed.

In addition, more than 8% of all US mortgages were past due or in foreclosure, according to Black Knight.

Read more on Business Insider.

The number of US home mortgage delinquencies has surged to the highest level in nine years as the coronavirus pandemic continues to hit family finances.

Total borrowers more than 30 days late surged to 4.3 million in May after a record jump to 3.4 million in April, according to a Monday report from Black Knight. In addition, more than 8% of all US mortgages were either past due or in foreclosure, the report showed. See the rest of the story at Business Insider

NOW WATCH: Pathologists debunk 13 coronavirus myths

See Also:

US weekly jobless claims hit 1.5 million, bringing the 13-week total to 46 millionMay’s blockbuster retail sales report overshadowed shifting consumer trends that could widen inequality in the USHomebuilder sentiment posts a record jump in June, signaling a housing-market rebound from the coronavirus pandemic

Original Source: feedproxy.google.com